When we started ProsperOps, the initial idea for our tagline was “The Robo-advisor for Cloud”. The only problem was, when we started talking to potential customers, many of them were unfamiliar with the concept of a robo-advisor. We eventually changed our tagline, but still believe the robo-advisor analogy is apt and powerful. As familiarity with robo-advisors is growing, now is a good time to take a deeper look at what a robo-advisor is and how the concept translates to cloud.

What is a robo-advisor?

Robo-advisors are automated, personal investing solutions that use advanced software and computer algorithms to implement investing strategies. Rather than using a human money manager or doing your own investment research and trading, a robo-advisor allows you to provide a few initial inputs (e.g., risk tolerance) then have day-to-day investing automated with little to no human involvement. They are called robo-advisors because the software “robots” do the work of building and managing a portfolio of investments on your behalf. Two of the most popular robo-advisors are Betterment and Wealthfront.

Once set up, robo-advisors are generally hands off, although it’s prudent to periodically review established guidance to ensure the robots are still implementing the right strategy for you. Because robo-advisors are software powered, they can deliver advanced features like tax loss harvesting, which watches the markets in real-time and algorithmically trades out of securities that have lost value and into similar classed securities. By doing so, your class allocation hasn’t changed, but you are able to recognize and write-off losses. Most DIYers don’t do this. Net net, with robo-advisors, you’re getting an automated investing outcome you generally can’t achieve on your own, with less effort.

Robo-advisors aren’t for everyone, but they are growing in popularity. Handing over investing to the robots makes sense for those who don’t have the time or interest in investing but still want the outcomes. And while there are certainly DIY investors that can beat the performance of robo-advisors, an algorithmic approach removes emotion, latency, and error and will, in general, outperform the average investor. As such, we believe robo-advisor adoption will continue to grow in the months and years ahead.

Similarities between personal investing and cloud

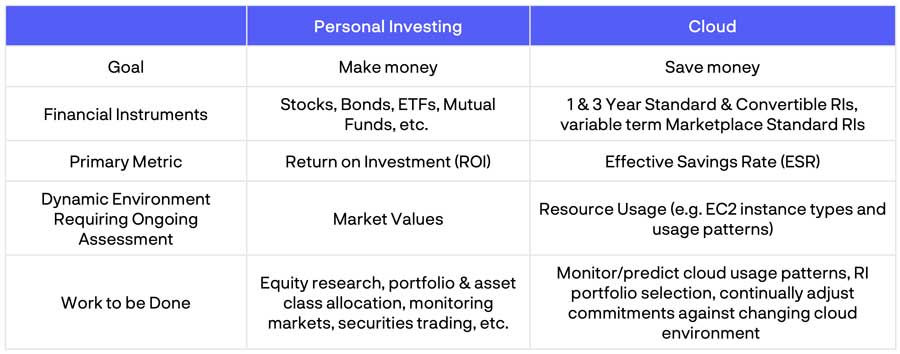

So what does that have to do with cloud? AWS and Azure offer tradable / exchangeable financial discount constructs called Reserved Instances (RIs). Just as you build and maintain an investing portfolio in the personal finance world to MAKE money, you build and maintain an RI portfolio in cloud to SAVE money. With investing, you build a financial portfolio of stocks, bonds, ETFs, etc. based on your risk tolerance and desired return. In cloud, you build a portfolio of RIs of varying discount rates and term commitments based on your anticipated resource utilization. Each requires assessing risk against desired returns, determining how to invest, monitoring your decisions and performance against a changing environment, and continually adapting your portfolio to optimize your outcomes. And with both, you can have good outcomes and make/save money or poor outcomes, where you lose money (yes, with RIs you can actually lose money). Investment performance is generally quantified by calculating return on investment (ROI). In the case of cloud, no broadly accepted savings performance metric exists which is why we created Effective Savings Rate.

Here’s a quick comparison of the two:

Ways to Implement

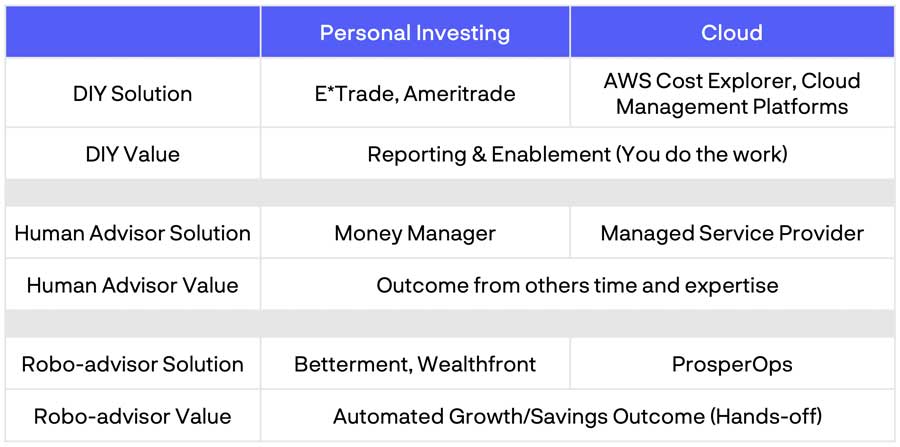

Each person/business needs to decide how they will implement an investing / savings strategy. There are generally 4 approaches:

1. Do Nothing

You can always do nothing! This would be like holding all your money in cash or running everything in cloud 100% on-demand. There is no risk, but there is also no return/savings either.

2. Do It Yourself

This requires educating yourself, keeping up with the latest changes and opportunities, finding (and paying for) tools, and spending the time to manage your portfolio on an ongoing basis. In personal investing, you might read articles from your favorite investment guru, open up an E*Trade account, purchase stocks, track investment performance, and reevaluate your positions as the market/economy changes. In the world of AWS, this typically means writing ad hoc scripts, using spreadsheets, reviewing Cost Explorer, using a 3rd party Cloud Management Platform, and/or setting up weekly or monthly calendar reminders to assess your RI portfolio against a changing EC2 environment. This is a perfectly valid approach but requires time and expertise day after day, month after month.

3. Leverage a Human Advisor

Another option is to hire a human advisor to manage your portfolio on your behalf. You are leveraging their time and expertise vs. your own. They will almost certainly use tools as well, but combine them with their expertise to deliver you an outcome. This is generally the most expensive option. In personal investing, you would hire a money manager. In cloud, you might hire a Managed Service Provider who would deliver RI management, likely as part of a broader suite of managed services.

4. Use a Robo-advisor

Lastly, as we’ve been discussing, you can leverage a fully automated solution. After establishing some initial parameters, software and computer algorithms deliver the outcomes. In personal investing, the leaders are Betterment and Wealthfront. In cloud, robo-advisors historically haven’t been an option—until ProsperOps. Now, you can hand off RI management to sophisticated algorithms that will real-time adapt your RI portfolio to a changing EC2 environment.

Here’s a summary of the options:

Closing

For those who are tired of managing RIs, are struggling to achieve EC2 cost savings, or just want a savings outcome without the effort, the power of a robo-advisor is now available for your cloud spend! Let the software robots make your life easier. Sign up for a free Compute Savings Analysis and learn how ProsperOps can save you money and time with hands-free RI management.