Autonomous Discount Management + Financial Reporting for AWS.

ProsperOps algorithms optimize cloud costs, 24x7. Save money, reduce commitment risk, and know the outcomes with zero human effort.

ProsperOps manages >$1B in annual AWS spend for hundreds of AWS Customers

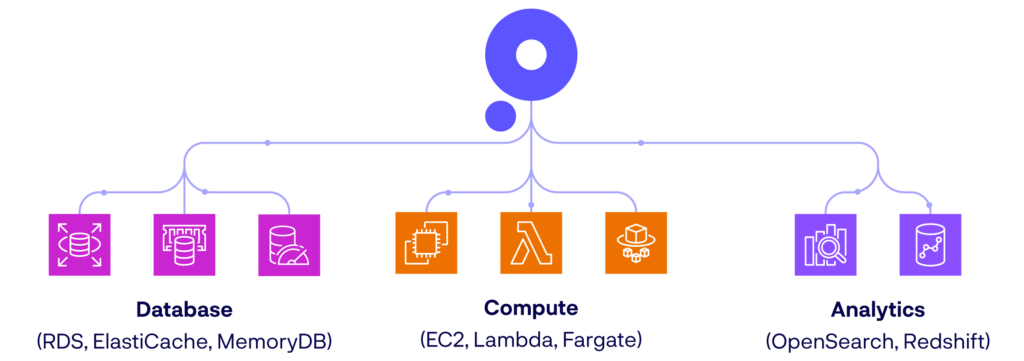

Comprehensive commitment management

Reduce your AWS cloud costs for multiple services in one platform.

Explore the ProsperOps FinOps Automation Platform

Autonomous Discount Management

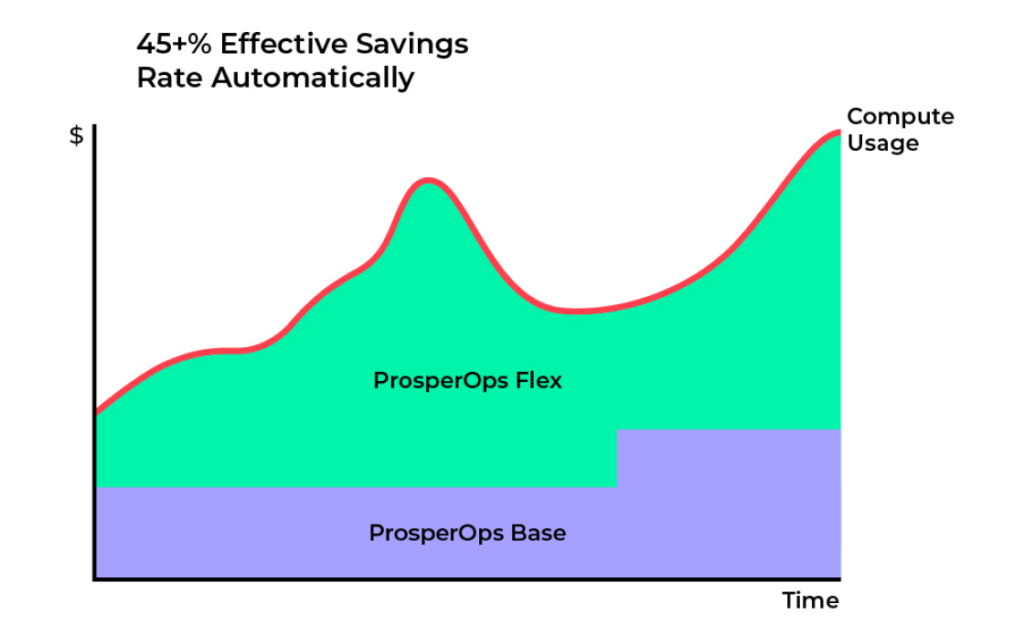

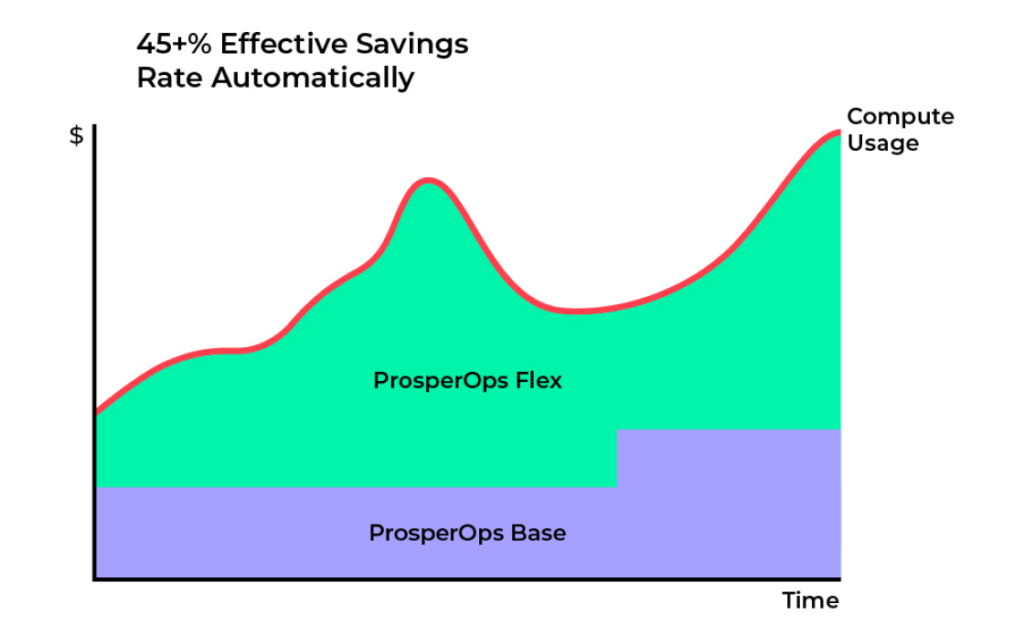

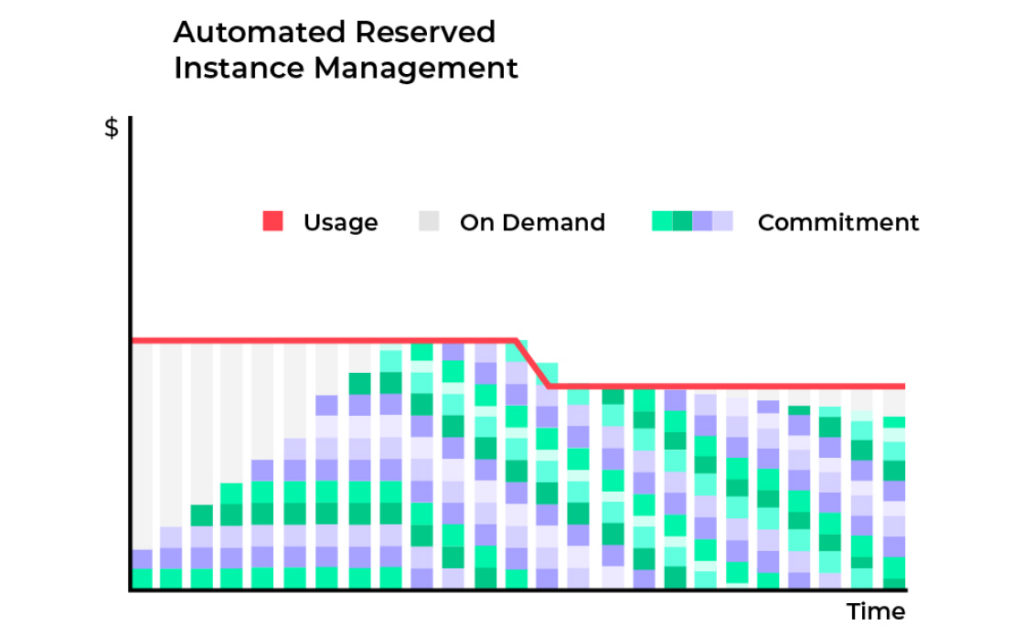

ProsperOps automatically creates and manages a portfolio of AWS Convertible Reserved Instances and Compute Savings Plans, to get you the most AWS compute savings while minimizing your commitment risk.

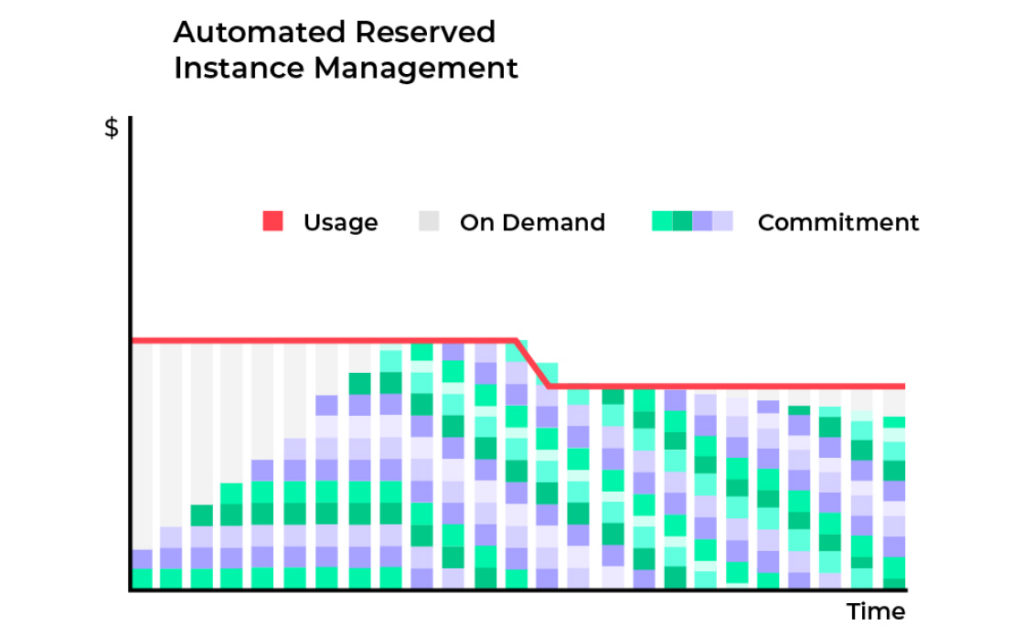

Automatically manages Convertible Reserved Instances to maximize savings while constantly adapting to changes in compute usage

- Flex Convertible RIs are automatically adapted to cover more dynamic usage

Manages AWS Compute Savings Plans for all compute types and regions

- You set the target and ProsperOps automatically adjusts the commitment to your desired state; zero management overhead for you

- ProsperOps fully inherits and manages your legacy AWS commitment portfolio

- Set quarterly prepayment guardrails for RIs and SPs and ProsperOps automatically does the rest

- Configure the Compute Shrink Allowance to absorb future usage drops without becoming overcommitted

- Align Reserved Instance and Savings Plan expirations with your EDP term to reduce platform lock-in

Maximize your savings, mitigate risk, and offload complicated work with RI automation for RDS, ElastiCache, MemoryDB, OpenSearch, and Redshift. With little to no ongoing effort, our platform intelligently deploys commitments so they can adapt to changes in usage.

Smart RI Automation for Complex Environments

- 24/7 automation that manages an optimal RI portfolio

- Generate more savings with risk mitigation that spreads or batches commits

- Configurable settings govern our automation – you are in control

Compute

ProsperOps automatically creates and manages a portfolio of AWS Convertible Reserved Instances, Standard Reserved Instances and Compute Savings Plans, to get you the most AWS compute savings while minimizing your commitment risk.

Automatically blends Convertible Reserved Instances and Standard Reserved Instances to maximize savings while constantly adapting to changes in compute usage

- Flex Convertible RIs cover dynamic usage with elastic and term-optimized commitments

- Flex Boost Standard RIs deliver the highest discount rates for predictable usage

Manages AWS Compute Savings Plans for all compute types and regions

- You set the target and ProsperOps automatically adjusts the commitment to your desired state; zero management overhead for you

- ProsperOps fully inherits and manages your legacy AWS commitment portfolio

- Set quarterly prepayment guardrails for RIs and SPs and ProsperOps automatically does the rest

- Configure the Compute Shrink Allowance to absorb future usage drops without becoming overcommitted

- Align Reserved Instance and Savings Plan expirations with your EDP term to reduce platform lock-in

Database & Analytics

Maximize your discount rate, minimize risk, and offload manual work with RI automation for AWS RDS, OpenSearch, Redshift, and ElastiCache. Automatically adapt to unforeseen change with zero engineering effort.

ProsperOps RI Commitments

- 24/7 automation that is constantly looking for smart ways to help you increase your savings

- Lower risk by automatically distributing RI commitments over time

- Provide current and future state context to help our algorithm adjust safely while maximizing your savings potential

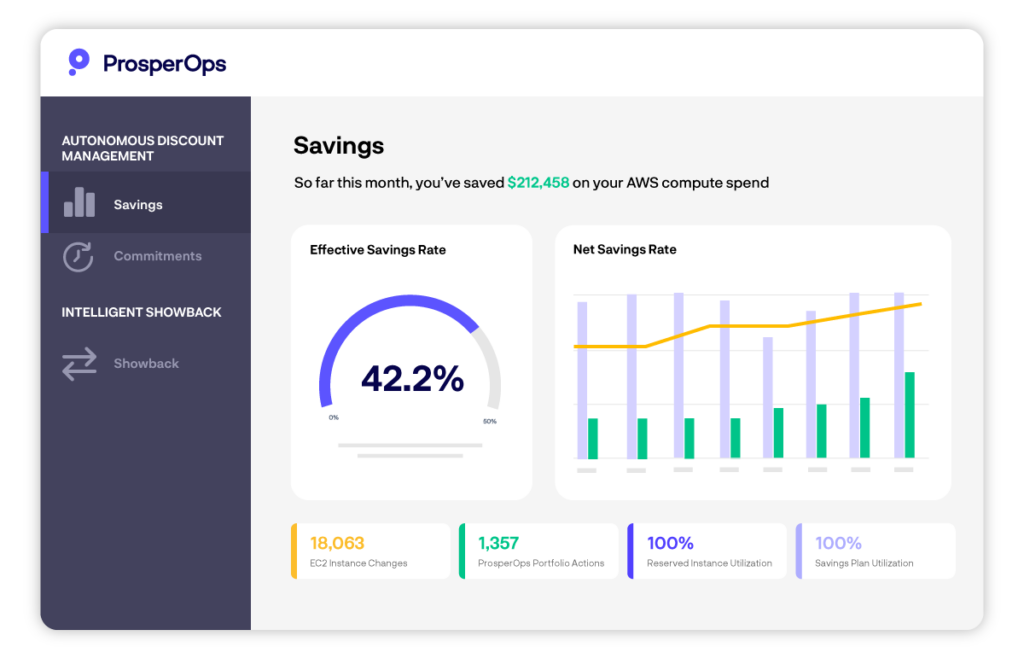

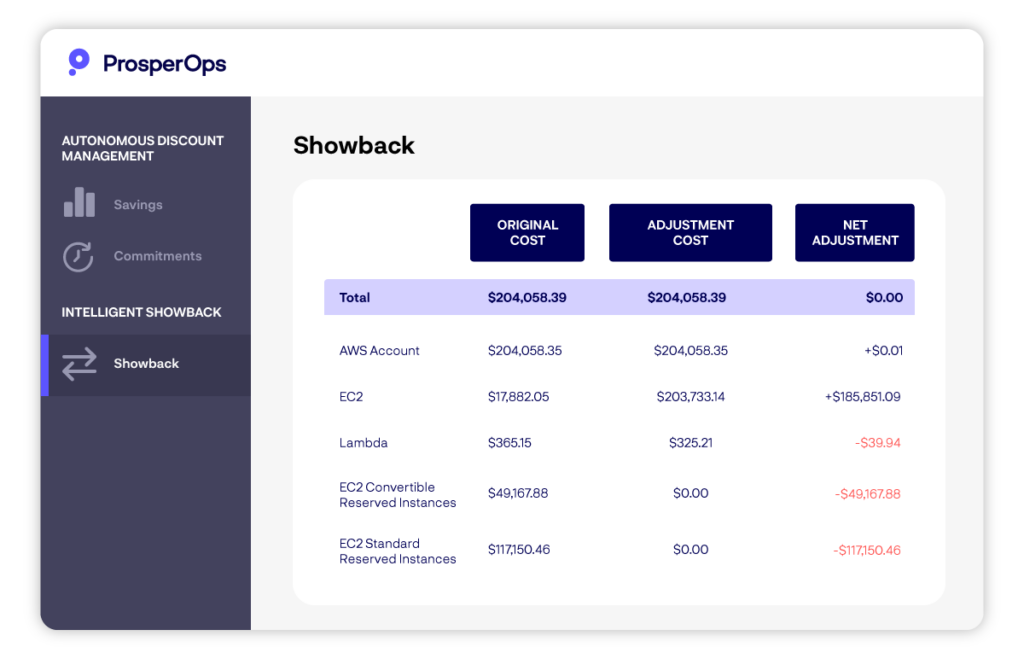

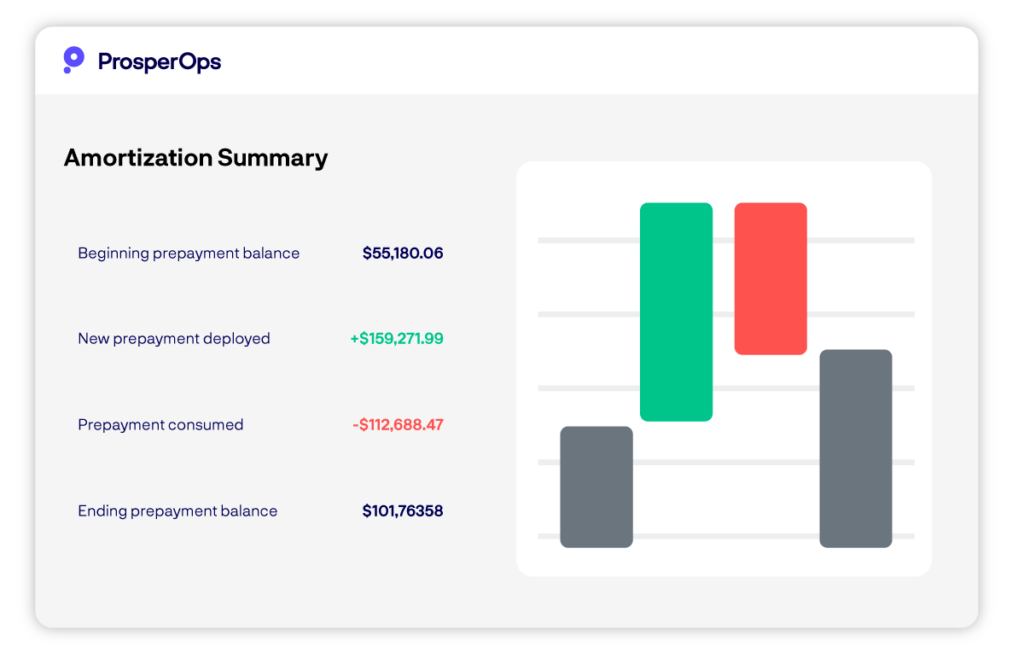

Finance and Accounting Reporting

Not only does ProsperOps save customers money, we provide the tracking and intelligence that finance and accounting teams need to properly allocate savings and close the books.

- Track monthly & lifetime total savings, coverage, utilization, Effective Savings Rate (ESR) and other FinOps metrics

- View Commitment Burndown, Weighted Average Commitment Duration and expiration timelines

- Deep links to AWS Cost Explorer for auditability of savings outcomes

- View costs and savings across regions, resources, service types, and more

- Control how savings benefits are shared among internal units

- Accurate savings allocations by business units, product lines and geographies

- Automatically track changes to the amortization schedules of all prepaid commitments; updated daily

- Proper accounting of cloud spend in the financial statements

Easily aggregate financial results across all AWS organizations for savings, compute spend, commitment coverage, Effective Savings Rate, and more

Platform Essentials

Results-based pricing

You don’t pay ProsperOps if we don’t save you money

Secure Platform

SOC 2 Type II compliant, Least-privilege IAM access with no agents

Enterprise Governance

Identity federation (SSO), role-based access control, and other governance features

Console Access For Partners and Service Providers

Cross-customer user access to our Console

Live FinOps Expertise

Unlimited access to cloud financial management experts

How does ProsperOps work?

Engineering team should be free to use the cloud as they see fit without the constraints of RIs and Savings Plans. ProsperOps watches your environment passively and automatically adapts discount instruments when there is a opportunity to improve your savings…without any involvement from you. Finance and accounting get access to everything they need to close the books.

Data Ingestion

Usage and cost telemetry is passively collected from your environment as engineering changes occur

Optimization Algorithms

Algorithms, governed by settings you control, identify cost-savings opportunities to increase your Effective Savings Rate

Insights

Engineering can understand their optimization results and Finance and Accounting get access to reporting to accurately close the books

Execution Engine

Commands are prepared and automatically executed via API

Data Ingestion

Compute usage and cost telemetry is passively collected from your environment as engineering changes occur

Optimization Algorithms

Algorithms, governed by settings you control, identify cost-saving opportunities to increase your Effective Savings Rate

Execution Engine

Commands are prepared and automatically executed via API

Insights

Engineering can understand their optimization results and Finance and Accounting get access to reporting to accurately close the books

See ProsperOps in Action

What customers say about ProsperOps

ProsperOps creates time and space for our team to focus on higher priority FinOps capabilities that enable the business to utilize our financial resources more effectively.

Stephen Arthur

Would highly recommend using ProsperOps. The assessment is free and minimally intrusive. We have been using the service for close to a year now and are saving a substantial amount of AWS costs. Amazing team to work with and set up was easy.

Kyle Hirai

Saves a considerable amount of money automating a mind-numbing task and the pricing is % of savings so it is basically free.

Maurice Butler

Action-oriented managed service—we set parameters for coverage and risk, and ProsperOps take actions with the best AWS financial instruments to meet our goals. Other platforms just make recommendations vs taking action.

Enterprise Customer

Truly a set-and-save solution. Not only did our Effective Savings Rate increase significantly, but the amount of time we spend buying and managing commitments has been reduced substantially.

Eric M.

ProsperOps delivers ongoing savings benefits to us, without any work.

Quang L.

As a relatively sophisticated user of AWS, we were already well over 90% coverage from RIs and Savings Plans before we started working with ProsperOps. With ProsperOps, we’ve managed to cut our EC2 costs by almost 20% more, and significantly reduce DevOps overhead at the same time.

Matthew J.

Frequently Asked Questions

Yes. ProsperOps manages inherited Standard Reserved Instances.

By design, our service is autonomous and it’s not uncommon for us to take 1,000s of optimization actions a month for a reasonably sized, dynamic environment.

ProsperOps can be used by either team. ProsperOps lives at the intersection of the DevOps and FinOps functions, where the fragmented management of RIs and SPs can create misalignment.

EC2, Lambda, and Fargate.

Yes, we can help you autonomously maximize savings for RDS, OpenSearch, Redshift, and ElastiCache.

The ProsperOps pricing model is different than most SaaS products and is directly tied to AWS savings generated (versus AWS spend):

- Organic usage growth notwithstanding, your cloud budget will grow from a lower AWS bill.

- In addition, the savings generated from the AWS bill pays the ProsperOps charge.

- With a term commitment, ProsperOps offers tiered pricing that delivers scalable economics as your savings increase.

The ProsperOps charge is called the Savings Share and its a function of savings calculated in dollars, driven by the rates applied against both Flex Savings and Base Savings.

- Flex Savings are the monthly savings generated from a Flex Boost Service Standard Reserved Instance and/or Convertible Reserved Instance that ProsperOps has purchased or optimized as part of the Services.

- Base Savings are the monthly savings generated from all other compute savings instruments (e.g., Savings Plans, inherited or customer-procured Standard Reserved Instances, Convertible Reserved Instances which ProsperOps has not optimized).

Yes, in which case the ProsperOps charge will appear on your AWS invoice.

AWS RI and SP Savings Calculation Method

AWS measures RI and SP savings as the difference between spend with RIs and SPs vs. spend if compute ran at on-demand rates. Savings values are impacted by a number of factors including utilization, coverage, and discount rates.

Note: Because RIs and SPs can be unutilized, it is possible to have negative savings (i.e., you paid more with RIs and SPs than if you had run at on-demand rates).

Authoritative System of Record

While the ProsperOps platform is responsible for ingesting compute usage telemetry and programmatically optimizing RIs and SPs to generate savings outcomes, ProsperOps considers AWS as the authoritative system of record for all RI and SP savings generated. The savings values shown in our Console will match AWS at all times.

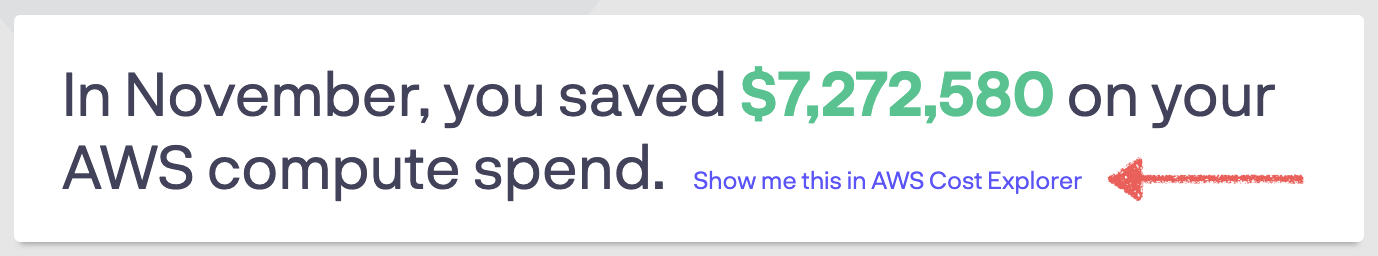

Auditability

ProsperOps makes it simple to audit the savings values provided in our Console by including pre-configured deep links to AWS Cost Explorer. These links allow you to easily compare ProsperOps values against authoritative AWS RI and SP savings data. These links are available in the savings summary panel at the top of the Savings Dashboard, as shown below. Savings values can be audited at any time and will match AWS whether the data is estimated mid-month or the month has been finalized by AWS.

What is an EDP?

For customers with sufficient spend, AWS makes available an Enterprise Discount Program (EDP, aka Cross-Service Private Pricing Agreement) which enables a flat discount on overall AWS spend in exchange for a long-term spend commitment.

Using RIs and SPs with an EDP

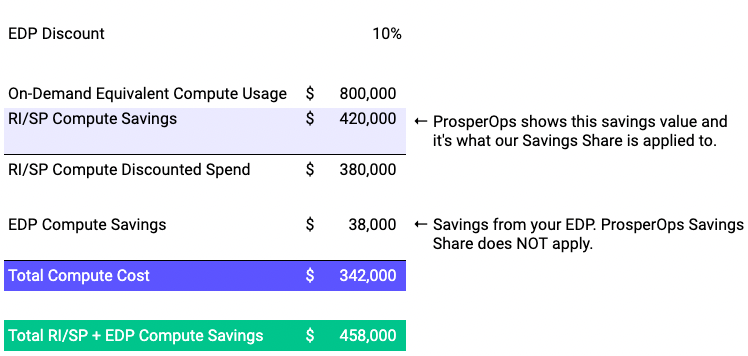

RI/SP discounts and EDP discounts stack, which means you can receive discounts from both savings programs at the same time! In that scenario, it's valuable to separate and properly account for RI/SP savings and EDP savings. This becomes critical with a service like ProsperOps since our Savings Share is specifically a function of the RI/SP savings generated.

Authoritative System of Record

As discussed in this article, ProsperOps considers AWS the authoritative system of record for RI and SP savings. This is true of EDP savings as well. As such, our savings calculations follow AWS' methodology for how RI/SP and EDP discounts are applied. This ensures the savings values shown in our Console always match the authoritative savings values from AWS.

AWS Discount Order of Operations

When the AWS billing system applies discounts, RI and SP discounts are applied first. Specifically, AWS calculates RI and SP savings upstream of whatever EDP discount is applied later in the billing process. This means RI and SP savings, as reported by AWS, are the difference between spend with list RI and SP rates vs. spend if compute ran at list on-demand rates. This savings value is what our service impacts and is thus what our Savings Share is applied to.

Once RI and SP savings are applied, AWS then applies the EDP discount to the RI/SP compute discounted spend amount. EDP savings are additive above and beyond RI and SP savings and fully accrue to the customer. Our Savings Share does NOT apply to EDP savings.

AWS Savings Calculation Example

This example illustrates how AWS applies discounts and calculates savings. ProsperOps follows AWS as the authoritative system of record for RI/SP and EDP savings values.

No. By default, you'll be billed separately by ProsperOps, but you'll also see lower AWS compute costs on your AWS bill.

If you prefer to purchase our services via the AWS Marketplace and have the charges appear on your AWS bill, please contact us and we'll assist you with signing up via that channel.

ProsperOps only needs least privilege access to actively manage your commitment discount portfolio and passively monitor your cost data and AWS compute estate. No agent is required, only an AWS IAM role. That role prevents our ability to manipulate (launch, start, stop, terminate) your engineering resources and we have no ability to access your EC2 instances, Fargate containers, or Lambda functions. As such, ProsperOps has no ability to impact application performance, availability, etc.

We're firm believers in the security principle of least privilege, so our permission set includes the minimum amount of access we need to run our analysis and nothing more.

So you enjoy the work of continually administering RIs and Savings Plans? 🙂

While we hope to save you money for the long term, you can cancel your subscription at any time.

If you cancel the subscription, you will be billed the Saving Share charge for the current month-to-date. Since the Savings Share includes savings over the contract term of managed RIs and Savings Plans, you will also be billed a final Savings Share charge for future to-be-realized savings of all ProsperOps managed commitments. See our service terms for additional details.

Subscriptions are monthly by default. If you are interested in a longer term plan, please contact our team.

Yes. For any prepayment our service deploys beyond monthly spend, customers must first approve a quarterly budget that acts as an additional constraint for our service (when applicable, this shows up as an additional setting in our Console). In that model, we produce a projected quarterly budget just before the beginning of each quarter which you review, adjust if you want, and approve. Once approved, our algorithms will only deploy prepayment in that quarter if it’s within the approved budget.

Upon a customer’s termination, ProsperOps will immediately bill the savings share charge for Services provided month-to-date.

If a customer terminates prior to the term expiration of a ProsperOps managed reserved instance, the unrealized savings share charges are due for the remaining reserved instance term or a maximum of 12 months.

Estimated unrealized fees are from deployed commitment in the Flex layer only. For example, if ProsperOps deploys a 12-month commitment, and a customer leaves in six months, you will receive a savings benefit from the commitment from the remaining 6 months and the unrealized savings share will be charged accordingly based on that estimate.

No. Since RIs and Savings Plans have the potential to match any applicable compute resource across all accounts in an Organization, all compute usage in regions where ProsperOps is enabled is monitored and analyzed in real-time.

Related Content

Request a Free Savings Analysis

3 out of 4 customers see at least a 50% increase in savings.

Get a deeper understanding of your current cloud spend and savings, and find out how much more you can save with ProsperOps!

- Visualize your savings potential

- Benchmark performance vs. peers

- 10-minute setup, no strings attached