Companies are increasingly reliant on cloud computing to drive their operations. However, this reliance can sometimes lead to uncontrolled cloud spending. This scenario poses significant challenges for businesses — particularly when unused cloud resources start to eat into their profits. According to the FinOps Foundation’s 2025 State of FinOps Report, out of the survey’s 861 respondents, more than 50% responded “workload optimization and waste reduction” as their top priority. That’s a clear signal that cloud cost optimization is still a major challenge.

Unlike traditional IT procurement where costs are predictable, cloud spend can vary dramatically in real time. This unpredictability impacts the bottom line and requires greater collaboration between IT, engineering, and finance teams. Without a coordinated approach, your efforts to manage cloud costs can be disjointed and ineffective — resulting in a lack of accountability and inefficient use of resources.

So, how can your organization tackle this challenge effectively? The FinOps framework is the answer.

In this article, you’ll learn everything you need to know about FinOps: what it is, why it’s needed, key principles, phases of the FinOps lifecycle, and how to implement it in your organization. Read on to explore the details.

What Is FinOps?

FinOps is a set of best practices, principles, and processes designed to help organizations manage their cloud financial operations. It’s a framework that combines financial management, operational governance, and business operations to optimize cloud costs and aims to help you get the most value from your cloud investment.

Key components of the FinOps Framework include:

- Visibility: Providing transparency into cloud costs across your organization

- Optimization: Continuously identifying and implementing cost-saving measures

- Governance: Establishing policies, standards, and guardrails to control your cloud spending

- Accountability: Assigning cloud costs to the appropriate teams or business units to promote ownership and responsibility

- Collaboration: Encouraging collaboration between your finance, operations, and engineering teams to achieve financial goals

Your organization may already have a few guardrails established to keep your cloud spend under control. Combining the above FinOps components addresses the issue on multiple fronts.

Why Is FinOps Needed?

At some point, you’ll need to explain why FinOps matters. This is essential to gain buy-in from your company’s decision-makers and to get all teams on board with the framework.

There has been a distinct change in the way procurement is handled, shifting from on-premise to cloud. While the desired outcome hasn’t changed (maximizing ROI, performance, and growth), the process looks a bit different, now requiring greater collaboration between CTOs and CFOs.

Before, with an on-prem arrangement, procurement was highly structured, with CTOs proposing the cost of equipment and the expected ROIs with a detailed breakdown explaining the investment’s necessity and outcomes. From there, procurement requests were approved (or denied) accordingly.

Now, with cloud computing, procurement happens in real time. Because on-demand resources can be provisioned with just a few clicks, it means that teams can now incur costs instantly without any pre-approved notions— a huge change from the traditional process’s highly planned approach prior to making any financial commitments.

This shift does have its benefits. Its flexibility means that CTOs and their teams can launch projects and scale resources quickly without getting caught up in the lengthy red tape approval process of traditional procurement cycles. However, it also becomes more challenging to manage and forecast costs, because they can change so quickly. This lack of predictability can, understandably, create tension between an organization’s technical and financial teams.

FinOps considers both the technical and financial aspects of cloud operations, bridging the gap between these departments. This can help organizations make better-informed decisions that account for both technical needs and budget constraints. With this additional transparency, FinOps enables businesses to take advantage of cloud flexibility — while also keeping control over finances.

The Benefits of the FinOps Framework

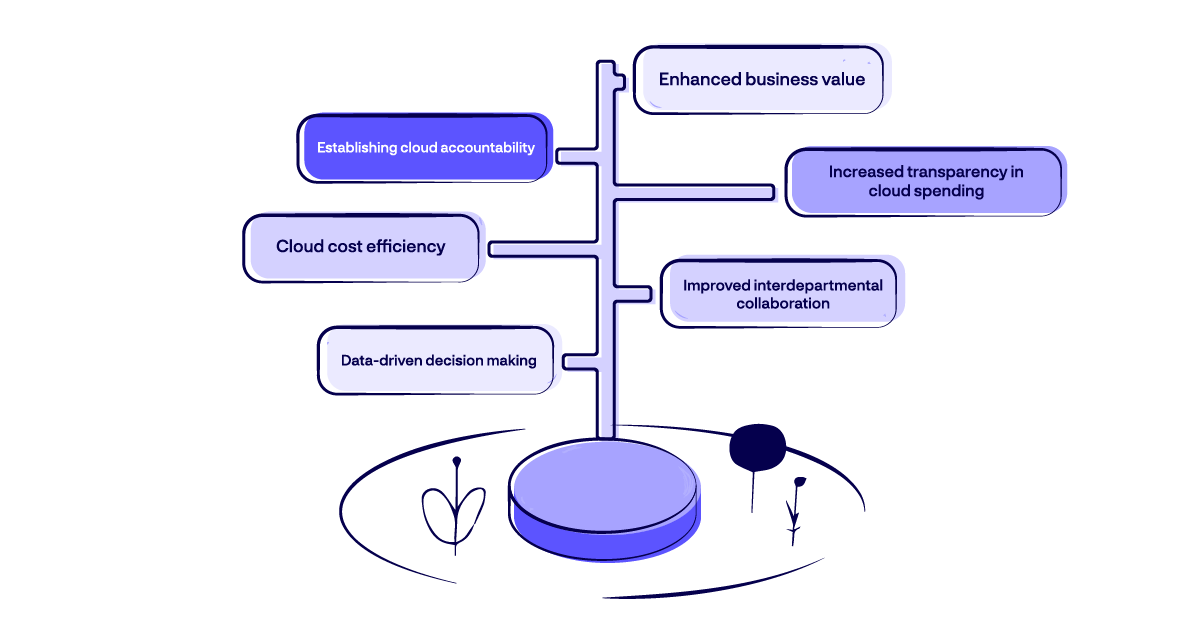

It may seem clear at this point that incorporating FinOps principles into your organization is a win-win for your teams. However, the benefits of FinOps go much deeper than helping you reduce costs (although that’s a big one!). Other significant benefits include:

Enhanced business value

The FinOps Framework is designed to maximize the business value of the cloud by aligning your financial and operational goals. According to McKinsey, by 2030 Fortune 500 companies may generate over $1 trillion from cloud enablement.

By focusing on cost-effective cloud usage, you optimize resources and improve performance. This alignment helps ensure every dollar spent on the cloud directly contributes to business goals.

Increased transparency in cloud spending

FinOps promotes real-time monitoring and reporting, allowing continuous tracking of cloud costs. With FinOps’s granular cost allocation, companies can see cloud expenses broken down by service, department, or application, ensuring that spending is accurately attributed and clearly understood across departments.

This level of detail helps organizations identify cost drivers and makes it easier to manage and optimize their cloud usage. As such, visibility into cloud spend is one of the most beneficial byproducts of FinOps.

Reporting tools make it easier for stakeholders to understand cloud spend and make informed decisions. With better transparency, you can spot areas where cost-saving measures can be applied effectively.

Establishing cloud accountability

By creating financial accountability within your teams, the FinOps Framework ensures everyone is responsible for their cloud spend. This means teams are more likely to use resources wisely and avoid unnecessary expenses.

Accountability also helps in setting budgets and tracking spend against those budgets, keeping cloud costs under control.

Improved interdepartmental collaboration

The FinOps Framework improves interdepartmental collaboration and creates a more cohesive environment. Several key aspects include shared responsibility, better communication, and unified metrics.

FinOps provides a standardized set of metrics and key performance indicators (KPIs) that are relevant to all departments: resource utilization percentage, percentage of costs associated with unallocated cloud resources, and hourly cost per CPU core, just to name a few.

FinOps also promotes financial accountability across all departments. This shared responsibility ensures that everyone, from engineering to finance, understands their role in managing cloud costs. Regular communication using structured meetings, transparent reporting, and cross-functional teams can help foster this accountability and is a cornerstone of a great FinOps culture.

Cloud cost efficiency

You only pay for what you need when you continuously monitor and optimize cloud resources. This can involve rightsizing instances, eliminating unused resources, and taking advantage of pricing models that offer better rates.

Research supports this: McKinsey & Company finds that businesses that implement FinOps can reduce cloud costs by 20–30%. Thus, efficient cloud cost management leads to significant savings and more efficient resource use.

Data-driven decision making

By leveraging metrics and analytics, you decide where to allocate resources, when to scale up or down, and how to balance cost against performance. Data-driven insights mean your decisions are not based on guesswork, but on real-time information that reflects your organization’s needs and usage patterns.

What Are the 6 FinOps Principles?

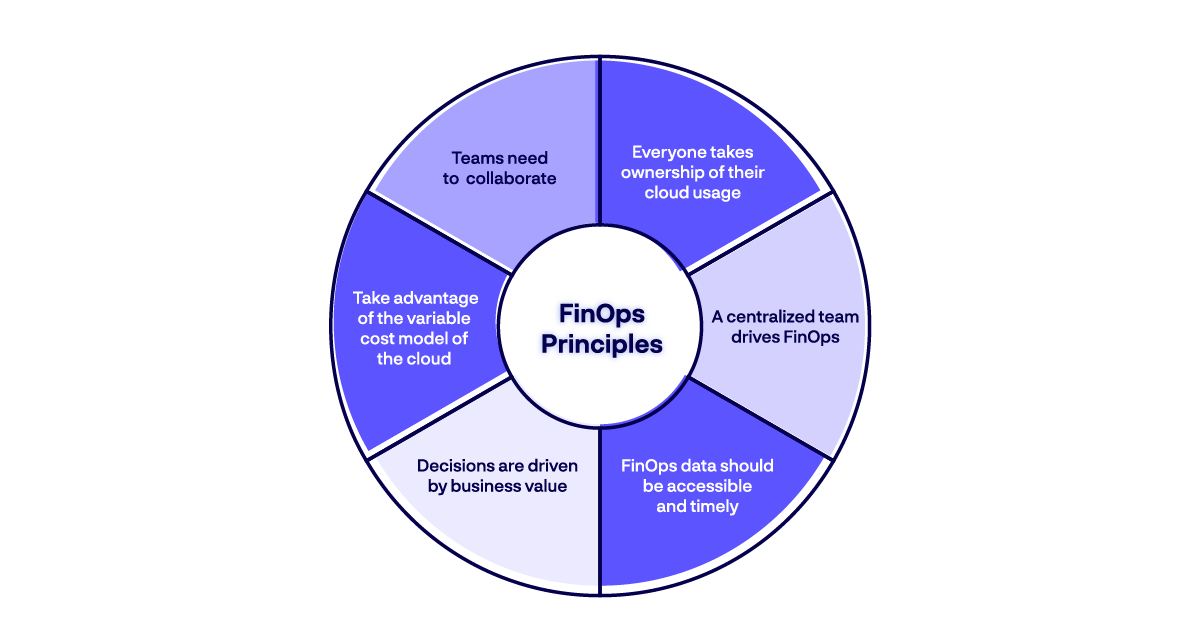

There are six FinOps principles that form a reliable structure for managing cloud costs effectively. They include:

1. Teams need to collaborate

Effective FinOps starts with strong collaboration among different departments. Engineering, finance, and accounting teams need to work together to maximize the business value derived from cloud investments. The collaboration enhances shared responsibility and promotes a unified approach to managing cloud costs.

2. Everyone takes ownership of their cloud usage

In FinOps, everyone in your organization is accountable for their cloud usage — or at least they should be. This principle ensures that all team members are actively involved in monitoring and managing their cloud costs.

Encourage a culture where everyone understands that their actions have financial implications. This leads to more conscious and efficient use of cloud resources.

3. A centralized team drives FinOps

Centralization is key in FinOps to streamline cloud financial management. A centralized FinOps team enables better oversight of cloud spend across departments, including rate optimizations, commitments, and vendor negotiations. This central authority helps ensure consistency across the organization and leverages economies of scale for better rates and discounts from cloud providers. By removing the burden of financial negotiations from engineers and operational teams, these teams can focus more on their core tasks, improving productivity and innovation.

4. FinOps data should be accessible and timely

Access to real-time, accurate data can significantly improve operational efficiency: Your teams need to see how much they’re spending, in real time, to make informed decisions. Timely data helps in identifying trends, spotting anomalies, and making quick adjustments as needed — which enhances the overall financial health and operational efficiency of the organization.

5. Decisions are driven by business value

Every decision in FinOps should be guided by its business value. This principle emphasizes assessing and prioritizing cloud investments based on their expected impact on operational performance and financial results. It encourages organizations to weigh the trade-offs between cost, quality, and speed, ensuring that cloud resources are utilized in ways that best support the company’s strategic goals and contribute to its growth and competitiveness.

6. Take advantage of the variable cost model of the cloud

The cloud’s pay-as-you-go model offers a flexible approach to resource management, allowing organizations to adjust their usage based on actual needs rather than fixed forecasts. This principle promotes the strategic use of cloud scalability to manage costs effectively, reducing the risks of over-provisioning and underutilization.

You can learn more about the FinOps Principles through the FinOps Foundation.

Who Are the Key FinOps Personas?

There’s a saying in FinOps: “It’s much easier for an engineer to spend $10K in the cloud than buy a $10 mouse.”

In other words, to purchase a mouse, an engineer must first get approval from their supervisor. Then, after buying it, they send the receipt to the finance department for approval. If the purchase goes through, the engineer is then reimbursed $10.

But that same engineer can access their cloud environment and deploy resources costing thousands of dollars, with financial implications often overlooked. Engineers typically focus on the technical merits of infrastructure without considering the immediate financial impact. Financial questions may arise only later when someone notices an unexpected increase in the cloud bill. This lack of accountability is exactly why FinOps is needed: every stakeholder needs to be held accountable for cloud spend.

As Erik Peterson, CTO of Cloudzero says, “Every engineering decision is a buying decision!”

Who are these stakeholders? In FinOps, various personas work together, including the following:

Leadership

Executives play a crucial role in FinOps by providing leadership and strategic direction. They set the goals and objectives for the team’s performance, budgets, and KPIs.

Typically, they have titles like:

- VP/Head of Infrastructure

- Head of Cloud Center of Excellence

- CTOs/CFOs/CXOs

Executives may work together to benefit the organization, but each has specific objectives, challenges, metrics, and outcomes they oversee and prioritize. For example, the CFO may focus on managing costs during growth, while the CTO is more concerned with streamlining processes for engineers to keep them as productive as possible.

FinOps practitioners

FinOps practitioners are often certified professionals who specialize in financial operations related to cloud computing.

They also implement and manage the FinOps Framework within the organization. Practitioners work closely with teams across the company to ensure financial strategies align with operational goals.

These practitioners have titles like:

- Cloud Cost Optimization Manager

- Cloud FinOps Analyst

- Director of Cloud Optimization

- Manager of Cloud Operations

- Cloud Cost Optimization Data Analyst

FinOps practitioners use data-driven insights to make recommendations about cloud spending, optimize resource use, and identify cost-saving opportunities. They’re responsible for educating other team members about best practices and tools used in FinOps.

Engineering

Engineering teams are essential in the FinOps Framework. They handle the technical aspects of cloud resource management.

These team members have titles like:

- Lead Software Engineer

- Principal Systems Engineer

- Cloud Architect

- Service Delivery Manager

- Engineering Manager

- Director of Platform Engineering

Engineering personas consider the efficient design and use of resources through activities such as rightsizing (the process of resizing cloud resources to better match the workload requirements), allocating container costs, and finding unused storage and compute.

Finance

Finance teams bring financial oversight to the FinOps processes. These professionals analyze spending data, track budgets, and ensure compliance with financial policies.

Members of these teams have titles like:

- Chief Financial Officer

- Strategic Financial Planners

- Financial Analysts

- Budget Analysts

- Financial Business Managers/Advisors

- General Ledger

They collaborate with FinOps practitioners to create cost forecasts and financial reports based on historic billing data. This helps ensure accurate forecasting models for better planning and budgeting.

Procurement

Procurement handles cloud platform relationships. These teams lean on insights from the FinOps team to identify, source, and purchase products and services from cloud vendors.

Team members may include:

- Technology Procurement Manager

- Global Technology Procurement

- Procurement Analysts

- Financial Planning and Analyst Manager

- Financial Business Advisor

- Sourcing Analysts

Procurement and sourcing specialists handle vendor management and negotiate contracts with cloud service providers. Their role is to secure the best possible terms and pricing for the organization, optimizing cost-effectiveness.

Product

Product teams are responsible for managing the business’s product(s), primarily focused on creating IT value for customers. They work closely with engineers to develop digital products and systems that deliver that value.

Roles within Product teams may include:

- Business Operations

- Product Managers

- Program Managers

- Systems Analyst

- Product Owner

Product teams are valuable FinOps players because they help predict how much cloud infrastructure will factor into the business’s product price, and use their insights to help the business make sound cloud investments.

Allied Personas

Besides the core FinOps personas, several roles from other disciplines also intersect with FinOps practices. These Allied Personas include individuals from areas such as Sustainability, IT Asset Management (ITAM), IT Financial Management (ITFM), Security, and IT Service Management (ITSM/ITIL).

While not directly involved in FinOps, they collaborate with FinOps practitioners to align their activities with cloud cost management priorities. For instance, ITSM focuses on maintaining service quality while balancing costs, and ITAM ensures efficient asset management that impacts cloud usage. These allied roles play a supportive function, ensuring the overall cloud ecosystem is cost-effective, secure, and sustainable.

For more information on FinOps personas, check out the FinOps Foundation’s educational content.

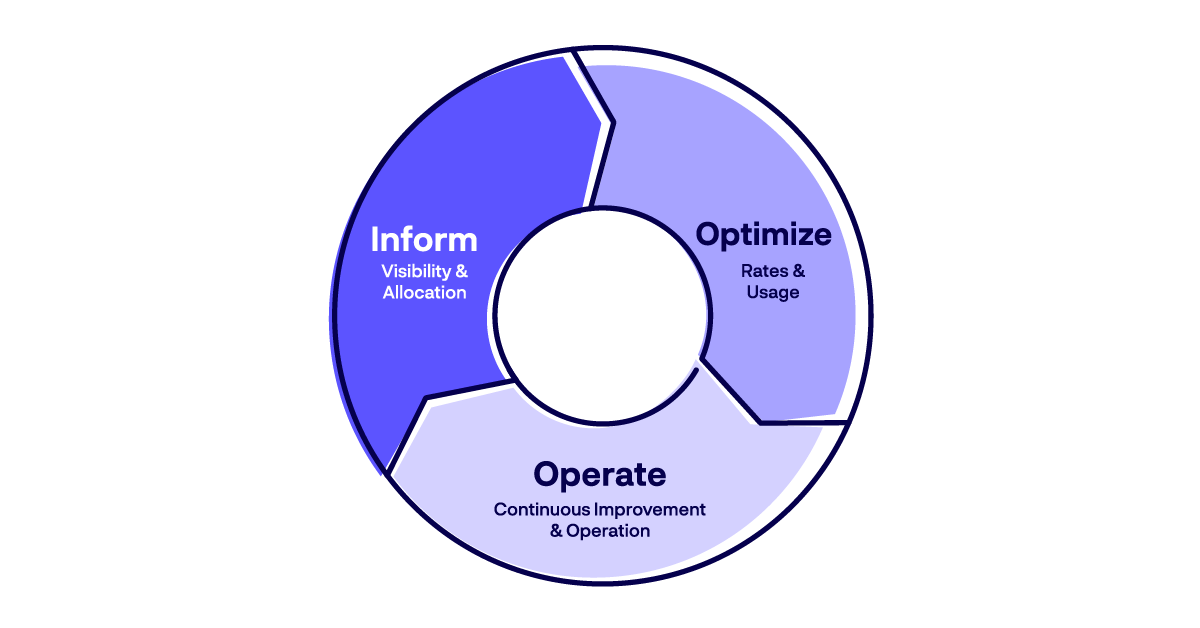

The Phases of the FinOps Lifecycle

The FinOps lifecycle is a journey through three key phases:

Inform

In the Inform phase, you gather baseline data to understand and track cloud usage and expenses. A comprehensive view of your cloud spending helps you pinpoint areas to optimize and build a foundation for better cloud cost management.

Once you identify your cloud costs, associate them with specific data sources and allocate them to different departments, business units or customers. By creating detailed reports and dashboards, you gain clear visibility into your spending.

This clarity supports informed decision-making about how resources are allocated. More than just tracking expenses, you also forecast future usage, set budget limits, and establish financial guidelines.

Activities in the Inform phase include:

- Map spending data to the business.

- Create showbacks and chargebacks.

- Define budgets and forecasts.

- Set tag strategy and compliance.

- Identify untagged (and untaggable) resources.

- Allocate shared costs equitably.

- Dynamically calculate custom rates and amortizations.

- Integrate showback/chargeback into internal systems.

- Analyze trending and variance.

- Create scorecards.

- Benchmark against industry peers.

Optimize

The Optimize phase is about implementing strategic improvements to enhance both cloud performance and cost efficiency. During this phase, you utilize the data collected in the Inform phase to pinpoint opportunities for reducing costs and optimizing resource use.

The primary focus is on cost avoidance, ensuring that unnecessary spend and cloud waste are identified and eliminated before considering other optimization strategies.

This phase is crucial for setting clear targets and establishing the groundwork necessary for the upcoming Operate phase. By methodically examining cloud usage and spending, your team is equipped to make real-time business decisions that significantly impact cloud optimization.

Key activities in the Optimize phase include:

- Identifying anomalies in usage and spending

- Finding and addressing underutilized services

- Evaluating the effectiveness of Reserved Instances or committed use discounts

- Comparing prices and assessing workload placement

Optimization is a continuous process that requires constant monitoring and adjustments to keep pace with changes in your business and cloud environment. By consistently refining your cloud operations, you ensure optimal performance and maximum cost-efficiency, thereby securing the best possible outcomes from your cloud investments.

Operate

In the Operate phase, you actively implement and manage the cost management strategies that have been developed in earlier phases. This phase is about action — putting plans into practice to meet your established goals without setting new ones. It focuses on integrating these strategies into daily operations to streamline and enhance organizational efficiency in line with company objectives.

During this phase, you enforce the cost and performance standards that have been set, utilizing automation to minimize manual oversight and ensure consistent resource management. Continuous improvement is a key theme, with the goal of refining processes and aligning spending with business goals.

This phase involves regular interactions among the engineering, finance, and accounting teams to ensure everyone is coordinated and committed to the organization’s financial objectives.

Activities in the Operate phase:

- Deliver spend data to stakeholders.

- Make cultural changes to align with goals.

- Rightsize instances and services.

- Define governance and controls for cloud usage.

- Continuously improve efficiency and innovation.

- Automate resource optimization.

- Integrate recommendations into workflows.

- Establish policy-driven tag cleanup and storage lifecycle policies.

Through diligent monitoring and effective operation, your team ensures that cloud costs are in check while still fostering the conditions necessary for growth and scalability.

You can find a detailed overview of the phases of FinOps here.

How ProsperOps Accelerates the FinOps Lifecycle

ProsperOps plays a critical role in accelerating the FinOps lifecycle by streamlining key processes and driving organizational maturity at a faster pace. Here’s how:

Centralizing the Management of Rates

One of the standout features of ProsperOps is its ability to centralize the management of cloud billing and rate optimization. To maximize the benefits of our platform, it is best practice for customers to establish a centralized billing team responsible for managing cloud rates.

This setup ensures successful rate optimization while decentralizing decision-making, empowering engineers to make cost-aware decisions directly. By structuring billing management centrally, organizations achieve better financial governance, while decentralization encourages engineering teams to take ownership of their cloud spend decisions.

Automated Optimization and Simplified Cost Reporting

ProsperOps automates actions within the “Optimize” phase, taking immediate steps to adjust and refine cloud usage for cost efficiency. Additionally, the platform simplifies cost reporting, offering valuable insights and tools like Intelligent Showback and Prepayment Amortization with a single click. These features support the “Operate” phase by providing quick, actionable insights that streamline operations, making it easier for teams to monitor and manage costs effectively.

Steps for Implementing FinOps in Your Organization

Implementing FinOps involves several key steps that help organizations manage cloud costs efficiently and drive financial accountability, including:

1. Research and collect the inputs for your FinOps adoption

Establish visibility and tracking of your cloud spend. Generating a picture of your organization’s usage and spend trend over time is a critical early step. All cloud service providers offer some form of billing dataset that can be used as the source of truth for a dashboarding tool — whether you build one yourself or use a vendor solution.

Determining and enforcing a resource tagging strategy is also a key early step that will pay dividends over time. Clear, consistent tagging makes spend attributable to workload owners and business units.

Look at your cloud consumption patterns, existing financial controls, and areas where costs are escalating, and collect feedback from different teams to get a clear picture. Understanding how various departments use cloud resources helps you establish a baseline.

Overall, this step lays the groundwork for your FinOps strategy — getting a grasp on your existing infrastructure helps you tailor your FinOps plan effectively.

2. Socialize FinOps within your organization

Now that you have a solid research foundation to build your FinOps strategy, you need to communicate the value of FinOps across your organization — especially to convince leadership that FinOps is a worthwhile investment.

Start by sharing the benefits of FinOps, such as cost savings and improved financial accountability. Organize meetings and workshops with key stakeholders to explain how FinOps can help the organization. Promoting awareness of FinOps helps make sure everyone is on board and understands their role in the process.

3. Establish a FinOps team

After you’ve done your research and collected buy-ins for FinOps adoption, the next step is building out your own team.

Include members from finance, operations, and engineering, ensuring all perspectives are covered. Also, don’t forget to assign roles clearly. For instance, finance can handle budgeting, while operations and engineering work on optimizing resource use.

4. Prepare your organization for FinOps adoption

To get everything ready for FinOps adoption, start by developing policies that encourage cost-effective cloud usage and implementing guidelines for managing cloud expenses.

Curate dashboards and reports. These dashboards help your team see real-time data on cloud costs and usage. Data and visibility are crucial; reports should be delivered regularly and on time. Leaders may want higher-level trend information, while application owners and engineers typically want more granular data.

You can also provide training sessions to familiarize employees with FinOps principles and tools. Preparing your team makes the transition smoother and helps establish new processes more effectively.

5. Define clear opportunities

Now you’re ready to define goals and metrics that will help you track progress. For example, you might aim to reduce cloud spend by a certain percentage or improve cost forecasting accuracy.

And, like we’ve mentioned already, you should align these goals with overall business objectives. Clear goals and measurable metrics give your FinOps team a direction and benchmarks to aim for.

6. Continuously monitor and optimize FinOps maturity

Of course, none of the above steps matter unless you regularly monitor your FinOps efforts and progress to ensure you’re on the right track.

First, conduct periodic reviews of your processes and performance against the defined metrics. Then, identify areas for improvement and make necessary adjustments. Continuously refining your FinOps practice ensures it remains effective and helps you realize ongoing cost savings and value from your cloud investments.

7. Establish and foster a FinOps culture

Establishing and fostering a FinOps culture remains a continuous practice. This means constantly reinforcing the importance of financial accountability in cloud usage. Encourage continuous improvement; you won’t get everything right on the first pass, so iterate and improve incrementally.

Encourage your teams to think about cost implications in their day-to-day operations and celebrate milestones and success stories to build momentum. Some organizations find a little friendly competition helps drive results; gamifying savings outcomes is a popular and rewarding approach.

However you approach it, making FinOps part of your organization’s cultural practice ensures its principles are embedded in daily workflows.

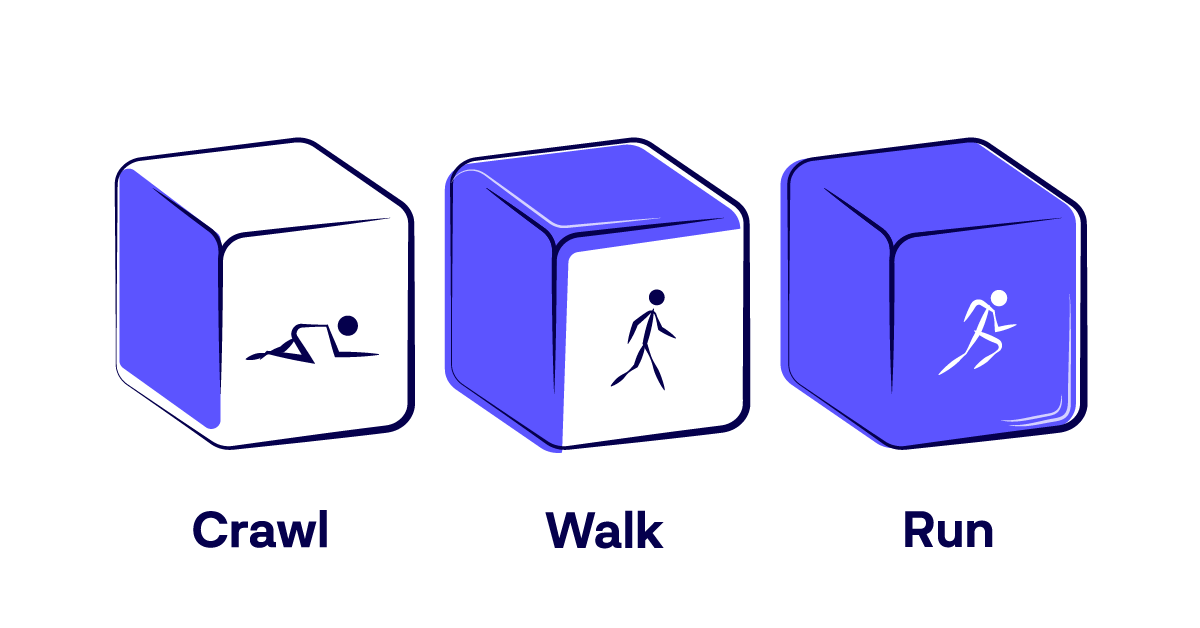

Understanding the FinOps Maturity Model

The FinOps Maturity Model guides organizations through three progressive stages, ensuring effective cloud cost management aligned with business value:

Crawl

Organizations establish foundational processes and KPIs to gain basic control over cloud spending. The focus is on understanding and addressing the most straightforward cost optimization opportunities.

Walk

At this stage, organizations enhance their automation and processes, covering most financial operations requirements. They begin tackling more complex scenarios and setting higher goals, though not all challenges are addressed immediately.

Run

This advanced stage involves full integration of FinOps practices across all teams, with a focus on high-level automation and addressing complex financial scenarios. The organization aims for the highest KPIs to ensure optimal alignment with financial health and business objectives.

Each stage builds upon the last, aiming to continuously improve the organization’s approach to cloud financial management and strategic decision-making.

The Concept of “No Runners in FinOps”

It’s important to understand that organizations may progress to different stages (Crawl, Walk, Run) across various FinOps domains and capabilities at different times. No organization is fully “running” across all capabilities simultaneously. The landscape of cloud operations and technologies is ever-evolving, with new strategies, techniques, and optimization tactics continuously emerging. Therefore, even advanced organizations must adapt and grow in specific areas as these new opportunities arise, ensuring ongoing improvement and efficiency.

FinOps Foundation explains the concept in more detail here.

Best Practices for Successful FinOps Adoption

To get the most out of your FinOps initiatives, incorporate the following best practices:

Centralize your FinOps team

You need a centralized FinOps team for clear communication and a unified strategy. Your team should include experts from different areas such as finance, operations, and engineering.

With a centralized approach to cloud financial management, it’s easier to enforce policies and governance across the organization. Your centralized team will drive initiatives and be responsible for cost management. And by having a dedicated team, you eliminate redundancy and confusion, saving both time and money.

In larger organizations, it may be useful to have ‘FinOps ambassadors’ who aren’t officially part of the central team, but are ‘spokes’ to the ‘hub’ of the central team. These individuals act as conduits for communication to and from the central team, and can help carry out tasks and champion new strategies, KPIs, reports, etc.

Offer comprehensive training and education

Providing comprehensive training and education ensures everyone involved understands FinOps and its practices. Training sessions should cover crucial topics like cloud cost management, budgeting, and cost optimization.

It should also include basic inter-departmental education, such as training finance teams on cloud billing fundamentals and educating engineers about financial reports and accrual accounting. The goal is to establish a common ground where the FinOps personas can understand each other’s pressures and motivations through a common lexicon.

You should also offer both initial training and ongoing education to keep up with new tools and techniques. Hands-on workshops and practical examples can be very effective here. Educated employees are more likely to adopt best practices and contribute to your organization’s financial success.

Regularly monitor and review cloud resources

Even after your FinOps practices are established, make sure your team sets up a routine to check usage, performance, and costs. Dashboards and reports can provide you with valuable insights and help you identify areas for improvement.

Continuous monitoring also helps in catching anomalies early and making timely adjustments. Taking a proactive approach ensures your cloud environment remains efficient and cost-effective. And don’t forget: Consistent reviews and monitoring also lead to long-term financial benefits.

In the ‘run’ phase, FinOps teams will implement machine learning to automatically catch and alert teams to anomalous spend or usage behaviors.

Be proactive about rate and usage optimization

Rate and usage optimization are the two core pillars of cloud cost management. There are myths around the sequence in which they should be performed: It’s believed that rate optimization should only be executed when you’re done with the usage optimization. But, one needs to understand that usage optimization in the cloud is never truly complete.

There will always be usage optimization areas to pursue: upgrading to current generation compute resources, migrating to ARM microarchitecture, converting traditional servers to containers, exploring serverless or microservices architecture, implementing instance scheduling, auto-scaling, or making storage tiers and life cycle more efficient. Because usage optimization is never-ending, teams should not defer their rate optimization efforts.

Leverage FinOps automation services

Leveraging FinOps automation is crucial, especially in the later stages of FinOps. As your team expands, so too will your FinOps goals, making manual management increasingly impractical and inefficient. Automation of tasks such as cost monitoring, resource optimization, and rate optimization is essential.

These tools not only facilitate easier management of cloud costs but also enhance accuracy in tracking by reducing manual effort. Additionally, automated solutions provide real-time insights, enabling teams to make informed, data-driven decisions. As operations scale, automating repetitive tasks allows your team to focus their efforts on more strategic, business-driven processes, ensuring that FinOps can continue to evolve effectively with your organization’s growth.

Top FinOps Services To Get Started With

Getting started with FinOps requires the right tools to manage and optimize your cloud spending. Here are a few top tools that can help you keep costs in check and allocate resources smartly:

ProsperOps

ProsperOps delivers a fully autonomous cost optimization platform with no operational or engineering trade-offs. We remove the complexity from cloud cost management and provide automated commitment-based discount management, helping businesses benefit from hands-free optimization.

ProsperOps automatically blends discount instruments to maximize your savings while minimizing commitment risk. We optimize the hyperscaler’s native discount instruments to reduce cloud spend and place you in the 98th percentile of FinOps teams.

AWS Cost Management Suite

AWS Cost Management Suite offers a range of tools to help you track and manage your AWS cloud costs. Key components include AWS Cost Explorer, AWS Budgets, and AWS Cost Anomaly Detection.

- AWS Cost Explorer allows you to visualize your AWS costs and usage over time. You can create custom reports to analyze spending patterns and detect cost anomalies, helping you understand where and how resources are being consumed.

- AWS Budgets enables you to set customized budgets for both cost and usage. It sends notifications if your spending exceeds the predefined thresholds, assisting in maintaining budgetary compliance.

- AWS Cost Anomaly Detection utilizes machine learning to monitor your spending patterns and automatically detect unusual changes that could indicate errors or unexpected spending. This tool is essential for early identification of potential issues, allowing for prompt corrective actions.

Google Cloud Billing

Google Cloud Billing is Google’s native offering for managing cloud costs. It provides detailed billing reports and dashboards that give you insight into your spending.

The platform offers billing export options to BigQuery, allowing advanced analysis of your cloud expenses. This makes Google Cloud Billing ideal for users familiar with Google’s analytical tools.

Google Cloud’s FinOps Hub helps organizations implement a data-driven approach to cloud financial management. Its dashboard gives you real-time insights, actionable recommendations, and peer benchmarks for optimizing cloud costs.

CloudZero

CloudZero translates cloud cost into metrics crucial for your business. As a cloud cost intelligence tool, it’s designed to help you understand the cost implications of your engineering decisions.

CloudZero provides a unified view of all cloud spend, including Kubernetes costs. It also offers features like anomaly detection, budget management, and insights. The platform also seamlessly allocates spend — even with varying tagging quality.

Azure Cloud Management Suite

Azure offers tools for monitoring, managing, and optimizing Azure resources. Azure’s robust set of tools helps you stay on top of your cloud spending, making it ideal for businesses heavily invested in Microsoft’s cloud services. Its main components include Azure Cost Management and Azure Advisor.

Cost Management lets you track cloud costs and usage with detailed reports and predictive analytics so you can anticipate future expenses and optimize current spending.

Azure Advisor provides recommendations on improving performance and security while reducing costs. Its integration with the Azure ecosystem ensures smooth functionality and better resource management.

How ProsperOps Can Help You With FinOps

With billions of annualized cloud spend under management, ProsperOps is the leading FinOps automation platform, helping businesses automate their rate optimization efforts for all three primary CSPs: AWS, Google Cloud and Microsoft Azure. It automatically manages discount instruments to maximize your savings while minimizing commitment risk.

ProsperOps sets itself apart by offering a range of features designed to automate and optimize cloud cost management with minimal user intervention.

- Autonomous cloud cost optimization: The platform automatically adjusts discount instruments to dynamic usage patterns, ensuring you’re always operating at peak cost efficiency without needing to manually tweak settings or parameters.

- Effortless implementation and operation: The platform integrates seamlessly into your existing cloud setup, requiring no changes to your infrastructure or operational workflows. This ensures a smooth transition and quick start-up, with ProsperOps operating silently in the background to maximize your savings.

- Automated commitment management: ProsperOps offers dynamic commitment management which allows you to adjust your commitments based on actual usage, reducing the risk of overpaying or underutilizing resources.

We optimize the hyperscaler’s native discount instruments to reduce your cloud spend and place you in the 98th percentile of FinOps teams.

See ProsperOps in action and learn how it can meet your cloud cost management needs — request a demo today.