Challenge

A global media company was spending upwards of $17 million per month on compute with AWS. Their internal team is a mature, run-stage, cost optimization program, using Reserved Instances (RIs) with the help of a third-party commitment broker.

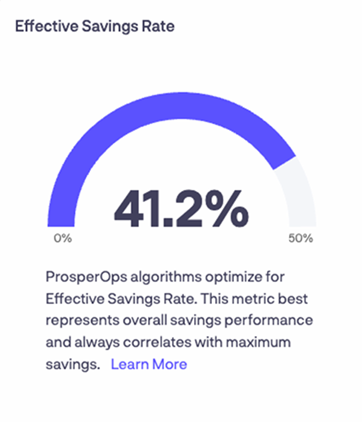

In one year, the company had achieved a 26% Effective Savings Rate (ESR), which placed them only in the 85th percentile of AWS cost optimizers.

ESR measures the discount being received compared to on-demand rates for cloud compute spend. It represents the true ROI of using discount instruments, such as RIs and Savings Plans.

Hourly Infrastructure Volatility

Hourly volatility, which was affecting this media company, made it even more challenging to plan capacity within savings plan rules and rigid commitment terms

Manual Cloud Financial Management

The broker coordinated with engineering to verify commitments they anticipated buying and selling. But a process requiring communication and validation before taking action couldn’t keep pace with infrastructure volatility, leading to:

- Inadequate Coverage: Less than 90% of compute usage was covered by discounts, leaving greater exposure to AWS on-demand pricing

- Discount mismanagement: Missed opportunity to secure optimal three-year discount rates (instead of the locked-in, one-year rates in use)

- Overcommitment: Caused by an inability to make timely adjustments; customer paid for cloud services they weren’t using

As a result, the customer missed an estimated $3 million in potential cloud savings.

Solution

The company turned to ProsperOps to automate discount instrument management and optimization for RIs and Savings Plans. ProsperOps onboarded the company and assumed management of more than 1,500 accounts in a matter of hours.

On average, the ProsperOps platform performs between 3,500 to 7,500 optimization actions per month for the customer via artificial intelligence (AI). AI enables the platform to align with usage without customer involvement. Its algorithms maximize customer discounts 24×7 and scale accordingly. Manual efforts can’t achieve this close and consistent alignment.

Results

ProsperOps increased the company’s ESR from its 26.4% benchmark rate to more than 42% (net of ProsperOps’ fees), in seven months. Incremental savings (net of ProsperOps fees) broke $2.1 million in the first four months alone. The company is expected to achieve more than $8 million in net incremental savings within 12 months of using ProsperOps.

Now the majority of the company’s AWS commitments are elastic, flexing to mirror consumption and reduce risk over time. The company trusts ProsperOps to handle the 24×7, elastic nature of cloud financial optimization so that its engineering team can get back to what they do best—building.