We talk to many businesses about AWS Reserved Instance management and how Reserved Instances (RIs), specifically Convertible RIs, offer the best bang-for-the-buck when it comes to lowering your AWS bill. Reserved Instances offer up to 75% off the on-demand rate, require no rearchitecture/refactoring to utilize, and generate savings immediately. Even with those benefits, we find that some users still flinch when it comes to making RI commitments and Reserved Instance management.

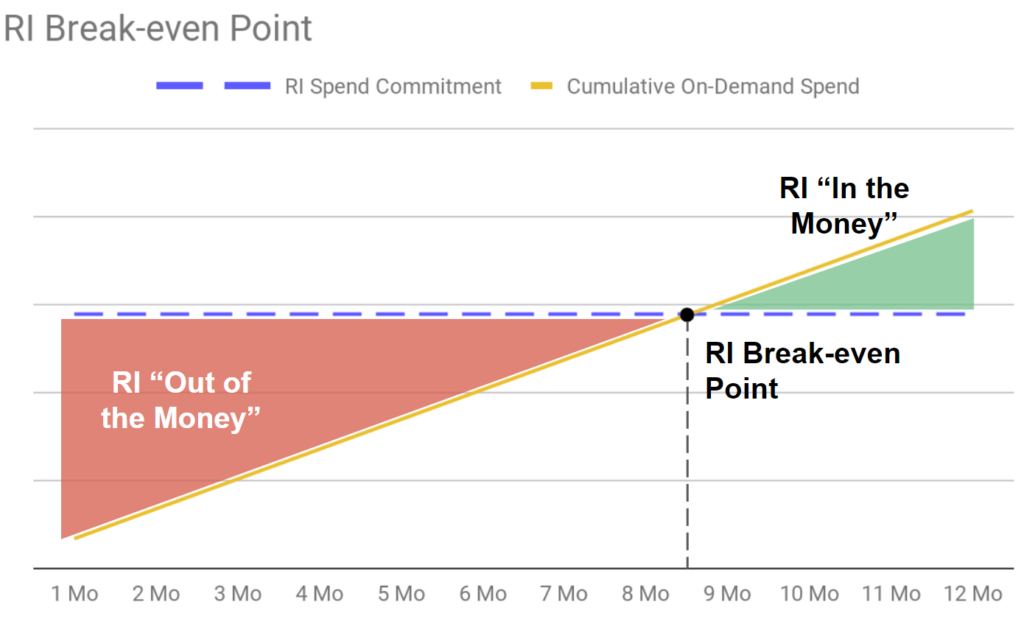

Managing RIs is complex and no one wants to find their finances upside-down because they purchased a Reserved Instance that ends up costing their company more money than simply paying on-demand AWS rates. However, the value of an AWS Reserved Instance is not a binary 100% or 0%. When you take into account the RI break-even point—the point in the term where the RI spend commitment equals the cumulative on-demand spend—you can better weigh the benefit vs. the risk.

Calculate your Reserved Instance Break-even

The advertised RI discount rate assumes the RI is matched to an EC2 instance 100% of the term commitment. This is the theoretical maximum discount rate but the reality is, for all but the most static environments, it won’t be matched 100% of the term, which means the Effective Savings Rate is lower. The key point to understand is that any utilization greater than the break-even point creates a favorable outcome relative to the on-demand alternative. In other words, after the break-even point you are “in the money” and are generating savings with RIs.

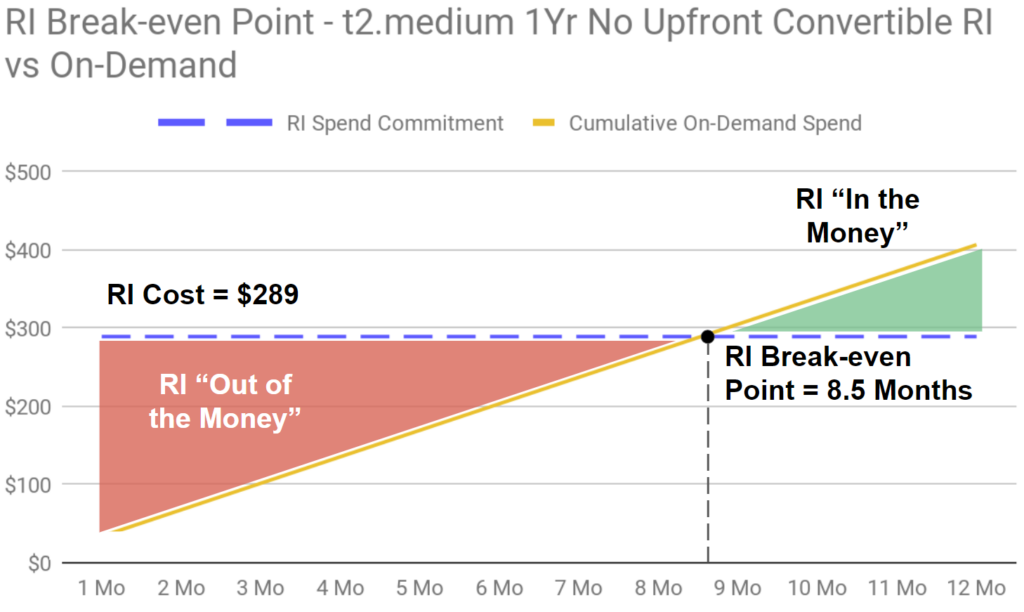

The RI break-even Point is calculated as: (1 – RI Discount Rate) x RI Term

Example:

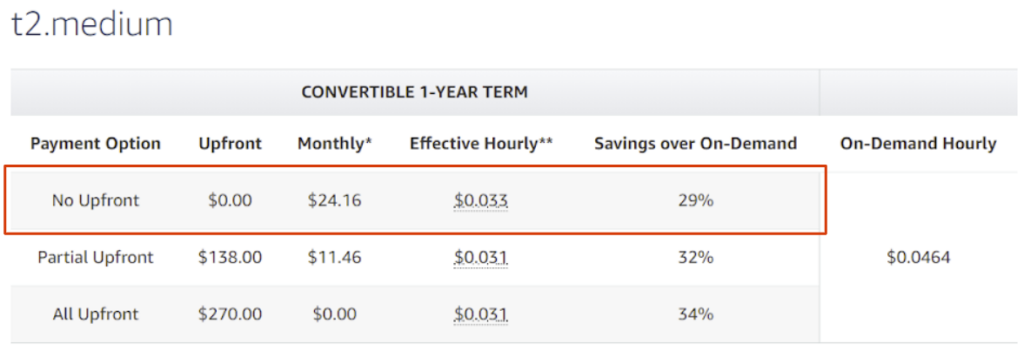

The discount on a t2.medium 1-Year No Upfront Convertible RI is 29% (shown as “Savings over On-Demand” in the figure above). The break-even point for this RI is calculated as (1 – RI Discount Rate) x RI Term = (1 – 29%) x 12 months = 8.5 months. If you expect to utilize the instance for more than 8.5 months over the 12 month term commitment you will save more by using an RI versus on-demand.

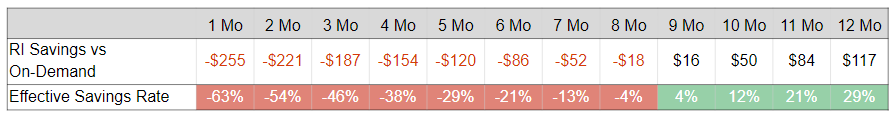

You can see how the dollar savings and the Effective Savings Rates of the RI are negative until the RI break-even point is met.

At ProsperOps this is a relevant concept for achieving your optimal Effective Savings Rate, especially as it pertains to using 3 year RIs. Average discount rates for 3 year RIs are approximately 50% for Convertibles, so appropriately layering 3 year RIs into your overall RI portfolio can materially improve your Effective Savings Rate. While we generally would not suggest using 3 year Standard RIs (due to the rigidity for such a long period), using some allocation of 3 year Convertible RIs in your portfolio is easier to rationalize when you understand the RI break-even point is around 18 months ([1 – 50%] x 36 months).

In summary, when making RI commitments you just need to be beyond the break-even point to save money. While 12 and 36 month commitments may sound long, 8.5 and 18 months (or whatever the break-even point is for the exact RI you are considering) are more palatable. And while having a match for a longer duration generates more savings, any savings is good savings!

Learn more about ProsperOps and Reserved Instance Management

At ProsperOps, our RI management algorithms maximize for your AWS cloud savings. To learn more about how ProsperOps can autonomously manage your Reserved Instances and commitment portfolio, request a free Savings Analysis.